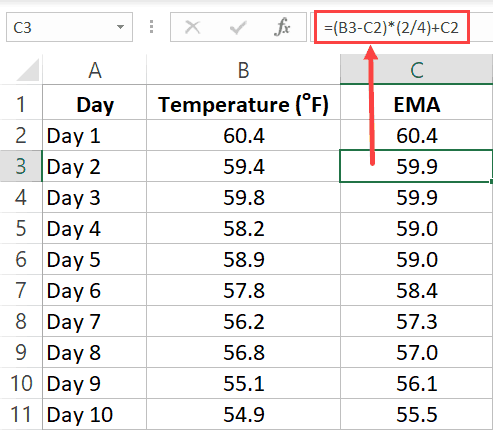

The a stands for smoothening or the amount of weight we choose to place on the equation this is often 2. EMAcurrent and EMAprevious are the current and the previous exponential. Here is the formula for the EMA: The variables for today and yesterday refer to Bitcoin’s current price averages. When trading, it is far more important to see what traders are doing NOW rather than what they were doing last week or last month. where xcurrent is the current data value. It’s because the exponential moving average places more emphasis on what has been happening lately. K Exponential smoothing constant C Current price P Previous periods exponential moving average (simple moving average used for first periods calculation). It is also termed as exponentially weighted moving average. This means that it more accurately represents recent price action. Exponential moving average gives more weight to recent or latest data than the past. Notice how the red line (the 30 EMA) seems to be a closer price than the blue line (the 30 SMA). Let’s take a look at the 4-hour chart of USD/JPY to highlight how a simple moving average (SMA) and exponential moving average (EMA) would look side by side on a chart. If you want to use a specific percentage for an EMA, you can use this formula to convert it to time periods and then enter that value as the EMAs parameter: Time Period (2 / Percentage) - 1 3 Example: Time Period (2 / 0.03) - 1 65. The formula for calculating the EMA is a matter of using a multiplier and starting with the SMA. Moving average ribbons allow traders to see multiple EMAs at the same time. Hence, the formula for calculating the exponential moving average is: EMA. Computing the exponential moving average involves applying a multiplier to the SMA. If you think about it, this makes a lot of sense because what this does is it puts more emphasis on what traders are doing recently. For this example, the weight of the preceding 10 days is 100 - 18.18 81.82. This would mean that the spike on Day 2 would be of lesser value and wouldn’t have as big an effect on the moving average as it would if we had calculated for a simple moving average. In our example above, the EMA would put more weight on the prices of the most recent days, which would be Days 3, 4, and 5. The calculation of an EMA is the same regardless of the period that you are using (minute, hours, day, week).

0 kommentar(er)

0 kommentar(er)